VCs used to view the heartland as an investment desert. But the pandemic has altered the whole idea of place.

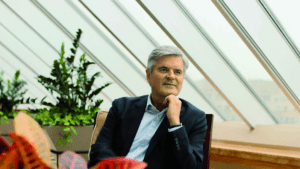

High Alpha calls itself a venture studio. That’s a combination incubator, early-stage investor, and startup consultancy. But it might better be called a venture catapult. Last year, the Indianapolis company showed its Midwestern can-do-ness in the midst of a raging pandemic by flinging out 10 startups–double the number to its credit in 2019. High Alpha did this in part by converting some challenges created by Covid-19 into businesses. “Where we start is with problems,” says Kristian Andersen, a High Alpha co-founder. “And 2020 presented no shortage of problems.”

High Alpha calls itself a venture studio. That’s a combination incubator, early-stage investor, and startup consultancy. But it might better be called a venture catapult. Last year, the Indianapolis company showed its Midwestern can-do-ness in the midst of a raging pandemic by flinging out 10 startups–double the number to its credit in 2019. High Alpha did this in part by converting some challenges created by Covid-19 into businesses. “Where we start is with problems,” says Kristian Andersen, a High Alpha co-founder. “And 2020 presented no shortage of problems.”

Your employees are scattered? High Alpha launched Filo, a service that improves your remote working experience. Can’t hear live music? High Alpha orchestrated Mandolin, which runs livestream concerts and fan portals for music venues and touring bands. And to hire the people needed to run these outfits, the company created Luma, an A.I.-based service that manages the interviewing process.

Something else changed last year in Indy and other parts of the Midwest and South: access to a deeper pool of funding. VCs who once spurned Indy because they couldn’t get there and back from the West Coast in a day are now airlifting cash into the city–not to mention Atlanta, Miami, Denver, and other towns that were never on their shortlist before. “When you have a total and absolute moratorium on physical travel, yet those dollars are being deployed, almost overnight things change,” says Andersen. “We’ve been breaking down this legacy venture capital model.”