By Joseph W. Boucher and Julijana Englander of Neider & Boucher. Neider & Boucher is a member of the Wisconsin Technology Council.

Prior to 1994, business entity selection in Wisconsin and around the country was much more limited, as fewer choices were available for entity structure. Business owners faced a choice: They could either pay lower taxes and receive more tax flexibility at the cost of assuming unlimited liability or enjoy limited liability in the corporate model and be subject to the double income tax regime of C-corporations. While some businesses chose limited partnerships, these were typically used for real estate tax shelter investments or for family estate planning, making them a niche choice.

On Jan. 1, 1994, Wisconsin established limited liability companies (LLCs), which dramatically changed the choices offered for business entity formation. There has been enormous changes in business entity choice over the last 30 years. In the last two calendar years alone, 93% of all business entities formed in Wisconsin were LLCs.

What impact does the passage of Wisconsin Act 258 and the Corporate Transparency Act have on business entity selection? To find the answer, let’s look at what should be considered when choosing a business entity.

We ask each client the following questions when selecting a business entity:

- What is the nature of your business?

- Where is capital coming from?

- How many owners are there going to be, and how actively will they be engaged in the business?

- What do you expect future growth to be?

- How do you expect to exit from the business?

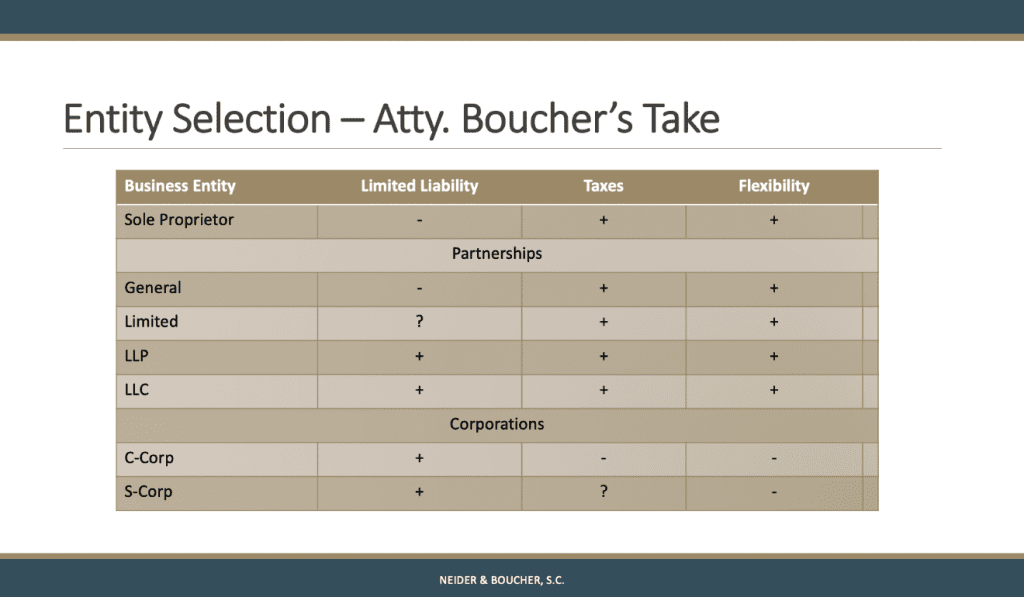

The following chart highlights the three key factors to consider before choosing a business entity: limited liability (Who wants unlimited liability?), favorable taxes (Who wants to pay higher income taxes?), and flexibility (Can the entity structure change should the need arise?).

Nature of the business

Businesses of all kinds face questions about entity selection — from tech startups, grocery stores and manufacturing companies to more specialized businesses with licensed professionals, like CPAs, lawyers, doctors and other highly regulated industries (such as insurance and banking).

Funding and capital

For businesses that have outside funding or are backed by venture capital, the investors often dictate the business entity form to be used, such as a C-corporation formed in Delaware. In these instances, tax issues become less relevant — the investors want simplified non-partnership tax treatment so they know exactly what they are going to get as an investor going forward.

Specialized real estate transactions are another example of capital coming from outsiders, and these transactions often utilize real estate tax shelters. Typically, these are formed as LLCs instead of limited partnerships — providing limited liability, simple formation and management of the business, and favorable income taxes. Limited partnerships are still used in specialized real estate transactions, but they require more complicated structures than simple LLCs.

Ownership

For questions about ownership, clients must consider the following:

- Are the owners the people who work in the business?

- Are the owners third-party investors?

- Are they a combination of both?

If ownership is limited to the people working in the business day to day, then a simple LLC is likely the best entity choice, acting as a current version of a general partnership that provides limited liability. For owners who manage the day-to-day operations of the business and are in a specialized field, such as medical professionals, lawyers or CPAs, they are typically limited to using either an LLP, an LLC or a service corporation.

Future growth

When predicting the future of a business, consider whether there is going to be a steady and significant flow of income. If that will be the case, then using an S-corporation may be advantageous. If the annual income will be inconsistent, then partnership tax treatment may be the best choice.

Exiting the business

Ultimately, what are the owners’ intentions for the business’s future? How are the owners going to exit the business? When they retire, are they going to sell to a third party? Or is there a possibility some owners will retire and others will buy them out?

How these questions are answered will impact the choice of business entity. For example, if the goal is to sell to third parties, then minimizing the income tax gain on the sale is paramount. For owners who intend to engage in an asset sale, choosing a C-corporation as their entity structure may lead to double income taxation. If owners wish to maximize their income tax flexibility, then choosing to structure their business as either an S-corporation or an LLC taxed as a partnership is advisable, as there should only be a single level of tax.

Wisconsin Act 258 and the CTA

How have Wisconsin Act 258 and the CTA impacted this discussion? They are a big distraction. As far as Wisconsin Act 258 goes, most people do and will consider the changes a welcome update. Act 258 modernizes Wisconsin’s business entity law, it harmonizes each business entity statute with the others, and it makes the state a more attractive place to do business.

Additionally, Act 258 changes the formalities for running a business. Some changes are particularly beneficial for small businesses; for example, written operating agreements are not necessary — businesses may operate using oral or implied agreements. As for single-member LLCs (in other words, sole proprietorships) or two or three people owning a business as general partners using an LLC, this change could be of great benefit.

However, as lawyers, we usually recommend there be a written operating agreement to clarify the key terms, rules and structure for the organization. For LLCs with more than two or three owners, each member/owner essentially has a veto right over certain decisions, such as bringing in new owners and selling the business.

Other than changes to operating agreements, the other significant change involves required annual reports. All annual reports must be filed online with Wisconsin’s Department of Financial Services, and all notices for the annual report are now sent electronically. We are very concerned that business owners will be unaware of this change or miss the filing notice. As a result, they may miss completing and filing annual reports and subsequently be administratively dissolved, which will be problematic for the businesses and the business owners.

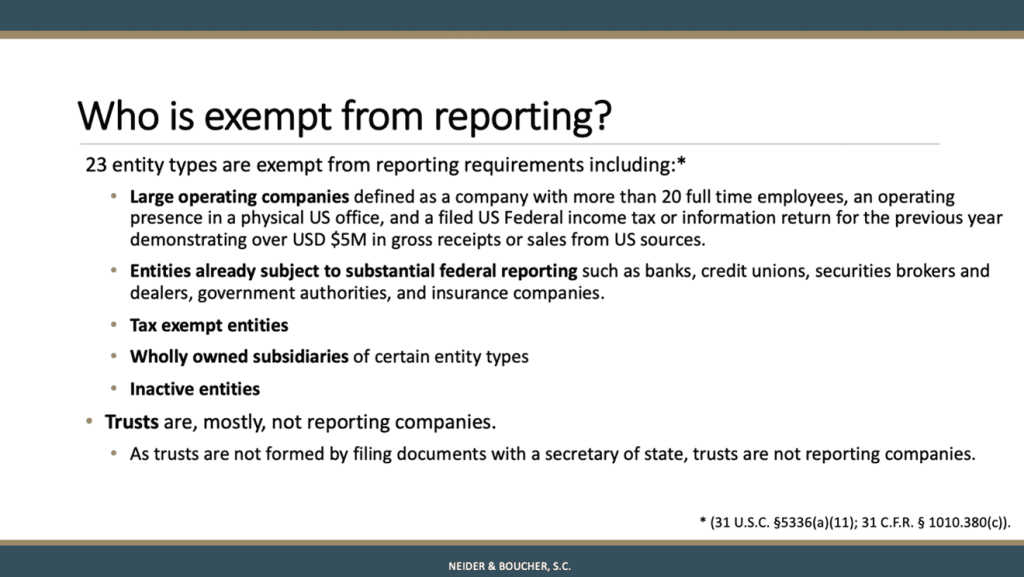

As far as the CTA, small businesses are not exempt. See the next chart for what the Act covers and who is subject to reporting. The CTA does not force businesses to change form and should not impact choice of business entity because all nonexempt businesses — whether corporations, LLCs or LLPs — must comply.

So, has business entity choice really changed because of these new laws? Our answer is no. For small LLCs with multiple owners, the businesses should still have a written operating agreement to clarify certain veto rights. While the CTA will not impact the choice of entity for a business, businesses will need to take affirmative steps to comply with its reporting requirements.

As accountants, you have annual opportunities to meet with clients to advise them of these changes and talk about filing annual reports. In fact, accountants should check to make sure that the businesses have not only filed the required annual reports but also that the businesses have not been administratively dissolved.

Accountants may also be called upon to assist businesses with their CTA filings and aid in compliance. These are good marketing opportunities that should not be missed.

Joseph W. Boucher, CPA, MBA, JD, is a founder and shareholder of Neider & Boucher S.C., a Madison law firm. Contact him at 608-661-4535 or jboucher@neiderboucher.com.

Julijana Englander, JD, is an attorney at Neider & Boucher S.C. Contact her at 608-441-2527 or jenglander@neiderboucher.com.

This column appeared originally in the January-February issue of “On Balance,” a publication of the Wisconsin Institute of Certified Public Accountants.